5 Techniques for Smaller Business people

No matter whether you might be operating your individual business or Doing the job for an employer, there are many matters you have to know. With the distinction between an LLC plus a partnership to how to control your finances, you can want to know the following pointers.

LLC vs partnership

Regardless of whether you are thinking about starting a business or simply just planning to mature your existing one, choosing the appropriate type of entity is a vital initial step. The limited legal responsibility business (LLC) and also the partnership are two company structures that have their unique positives and negatives. Whilst each individual small business is unique, There are several details about both equally that will help you end up picking.

A partnership is a business arrangement by which two or more people be a part of forces to work as associates. The associates have the exact same authorized position but get pleasure from the advantages of a restricted liability. Using a partnership may be a good way to prevent investor involvement and even now delight in a lot of the tax great things about a company.

The constrained liability organization (LLC) will be the king on the minimal legal responsibility organization constructions. It really is the ideal choice for a minimal legal responsibility small business as it allows for a decreased risk of private legal responsibility. In addition, LLCs are able to convert to companies devoid of an excessive amount of difficulty. The LLC has no Restrict on its lifespan.

Getting The Business Owners To Work

The confined legal responsibility organization may not be the sexiest of all enterprise buildings, but it really's a gorgeous selection for lots of business people. The LLC is actually a go-by way of taxation entity, indicating earnings are transferred straight from a person spouse to the subsequent. This can be the main reason why a lot of entrepreneurs choose LLCs more than partnerships.

The confined legal responsibility organization may not be the sexiest of all enterprise buildings, but it really's a gorgeous selection for lots of business people. The LLC is actually a go-by way of taxation entity, indicating earnings are transferred straight from a person spouse to the subsequent. This can be the main reason why a lot of entrepreneurs choose LLCs more than partnerships.Generally speaking, LLCs and partnerships are similar, but the LLC is the greater intricate of The 2. An LLC is shaped by submitting content of Group Along with the secretary of state. This paperwork will often require a Federal Employer Identification Number (EIN) - an EIN can be a tax identification variety for corporations. The better part is that you can very easily apply for an EIN online. The IRS would not cost a charge for issuing an EIN.

A very powerful explanation to type an LLC is legal responsibility safety. The LLC safeguards associates' assets from company legal responsibility. It is also a good idea to sort an LLC ahead of converting to a company. A nicely-drafted working arrangement may help prevent expensive disputes.

As for the best way to form an LLC, the apparent preference is to hire a legal professional. However, a lot of businesses are started out by individuals who would not have enough time or funds for a lawyer. To help you lower your expenses and start, CorpNet presents business enterprise development and compliance providers for corporations of all dimensions in all 50 states.

Hispanic-owned enterprises while in the U.S.

Across The usa, Hispanic-owned businesses have grown to be the swiftest developing section of compact corporations. Their advancement fee is in excess of double the nationwide normal. On top of that, these companies provide A huge number of Positions and add into the US economic climate. However, many proprietors struggle to secure the funding they want. You will find a will need for just a increased range of financing sources for Hispanic companies.

Hispanic-owned corporations are disproportionately owned by men. Over 50 % of these are sole proprietorships. On the other hand, Gals are starting more enterprises than previously in advance of. They are also launching much more businesses during the economic and wholesale industries.

Latinos also contribute significantly to the Market as companies. They produce more businesses for every capita than almost every other group. In fact, one particular out of every two hundred Latinos results in a fresh business monthly. This is certainly also a reflection in their acquiring power.

What Does Business Owners Do?

Hispanic-owned organizations lead on the US economy by making A huge number of jobs. Nevertheless, they are also prone to economic shocks. Despite this, there is a increasing network of financing sources to guidance them. The Hispanic Entrepreneurship Coaching Plan offers totally free mentorship and organization education to help you entrepreneurs Construct their corporations.

Hispanic-owned organizations lead on the US economy by making A huge number of jobs. Nevertheless, they are also prone to economic shocks. Despite this, there is a increasing network of financing sources to guidance them. The Hispanic Entrepreneurship Coaching Plan offers totally free mentorship and organization education to help you entrepreneurs Construct their corporations.In line with US Small Enterprise Administration information, greater than fifty percent of Hispanic-owned businesses been given approval for your loan. The typical credit history score for these enterprises is 594. Even so, several fiscal institutions are unwilling to lend to enterprises which have an average rating beneath 600. This can cause escalating debt and compounding capital complications with the enterprise operator.

Even with these challenges, Hispanic-owned enterprises are escalating in range. Consequently, they add into the US economic climate by much more than $800 billion yearly. The fastest growing Hispanic-owned organization locations consist of towns in Texas, California, and Florida. On top of that, Illinois and Arizona have been rated in the highest 10.

These business owners also wrestle to scale their companies at precisely the same level as non-Hispanic companies. They're also more more info prone to be sole proprietors. Moreover, these entrepreneurs tend to be more vulnerable to economic shocks.

The Best Guide To Business Owners

Together with the economic Rewards that Hispanic-owned enterprises give, they also give a terrific possibility for financial growth. With a considerable pool of business people, there is a superb possible for Hispanic corporations to develop.

Together with the economic Rewards that Hispanic-owned enterprises give, they also give a terrific possibility for financial growth. With a considerable pool of business people, there is a superb possible for Hispanic corporations to develop.Artistic task titles can energize personnel and cut down worry

Utilizing a singular career title is usually a major earn in your staff and your business's Total properly remaining. Not just will you have the ability to keep the staff members joyful, additionally, you will manage to get additional out of them. A properly-preferred title will also show off your business's swagger and make your workers come to feel appreciated.

The most beneficial titles are not simply catchy but In addition they exhibit your employees' special personalities and exhibit that you are prepared to spend money on them. When you are Doubtful of what titles to provide your workers, request them for his or her feeling. You might even let them choose the titles themselves. This may also show your dedication to range and also a pleasurable operate spot.

Whilst a title could be a little far too risque, It is normally a smart idea to Allow your workers pick the titles that finest replicate their operate, and the skills they bring into the table. In fact, allowing for your team to select their own titles is often a absolutely sure fireplace method to retain your best employees.

There is no doubt that a witty career title will minimize pressure for the staff, permitting them to better execute their roles. In actual fact, a examine involving 22 personnel members from the Make-A-Desire Basis identified that personnel had been happier plus more effective if that they had the oppurtunity to choose their own personal title. It is also a smart idea to have a small prize pool or prize giveaway for your personal personnel, so they can choose the titles that finest signify their exclusive personalities.

Using a unique title to market innovation is a great go for virtually any organization, specially a startup. You can be surprised at the amount of staff that are ready to check out their hand at a brand new task title. The naming method is a fantastic crew creating physical exercise, and it's also a fun approach to show off your business's unique sense of humor. This may also help you keep top rated expertise by demonstrating that you are willing to invest in the organization's future.

Having a exceptional title in your team is the best way to reveal that you choose to care about them and that they are really worth your time and expense.

Managing funds correctly

Managing funds thoroughly is an important part of managing a company. It may help stop unexpected enterprise credit card debt, preserve a positive income movement and be certain that your more info business is financially rewarding. The primary basis for failure in a business is failing to be familiar with the quantities. It is vital to set very clear fiscal projections and to consult money authorities.

Managing your funds correctly incorporates monitoring your bills, environment plans, and generating intelligent expenditure decisions. Failure to observe expending behavior can cause overspending, misuse of resources, and late payments. Employing revenue for unexpected emergency resources could also aid to further improve income move.

Handling funds effectively for business people begins with making a budget. A budget is a simple list of the fees that your organization will incur. It features preset and variable prices. You could critique these prices month-to-month. It is also crucial to decide regardless if you are expending over you happen to be creating. This will enable you to discover locations where you can Lower fees and preserve.

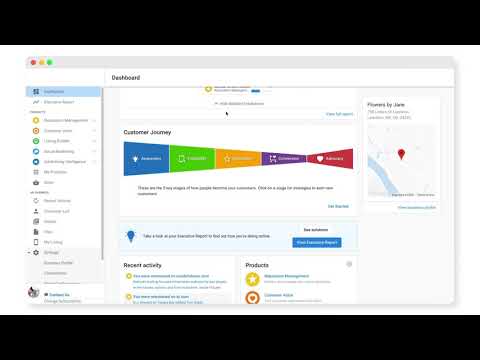

You might also would like to think about using accounting software to keep an eye on your paying out and earnings. These software package packages are comparatively inexpensive and can be employed by any one. They can be accessed from the cloud.

Yet another way making sure that your small business is controlling funds adequately is to make a income reserve. This may be a business financial savings account. The extra money you make from your online business bills is usually put click here In this particular account to be used for the duration of an unexpected emergency.

It is additionally imperative that you keep an eye on inventory purchases and product sales. If your enterprise incorporates a small stock, it may well lead to clients to show away. It could also lead to supply chain interruptions. While you are a brand new company, it could be hard to estimate exactly how much you might spend.